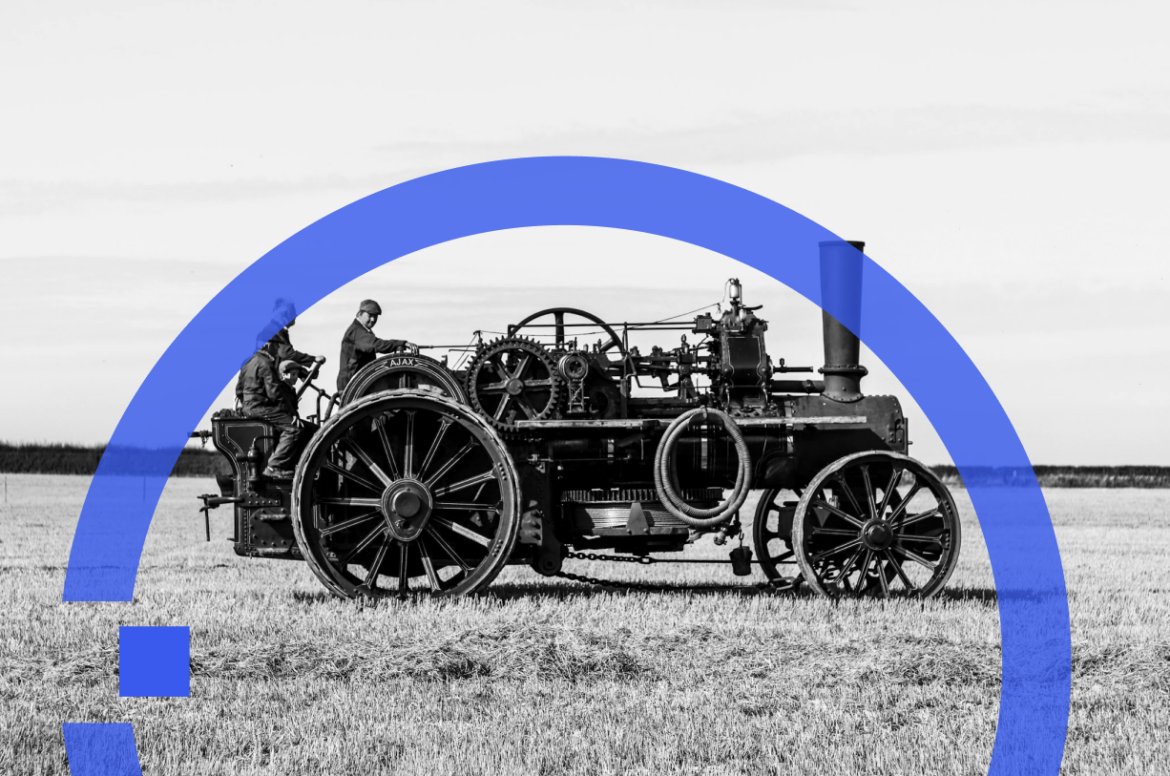

The Fuel That Drives Progress

Steam was the lifeblood of the Industrial Revolution, powering locomotives, factories, and ships. But with its immense power came danger—boiler explosions were common and devastating.

Fast forward to today, and financial data is the fuel driving financial service innovation. It powers financial transactions, payments, banking systems, and financial technology solutions. But as steam explosions were once a fact of life, data breaches and fintech failures have become a modern reality, shaking public confidence.

Tipping Points: Tragedy Sparks Change

On April 27, 1865, the steamboat Sultana exploded on the Mississippi River, killing over 1,800 passengers—both prisoners and soldiers returning from the Civil War. This disaster underscored the need for stricter boiler safety regulations and marked a turning point in the standardization of industrial safety. In the financial sector, a growing number of data breaches served as a similar wake-up call. Due to inadequate protections and regulatory gaps, customers’ identities and funds can be at risk.

A Call for Standards, Safety and Insurance

In 1857, recognizing the frequency of catastrophic explosions, a group of engineers and scientists formed a polytechnic club to design a better steam engine. Their belief was simple: if the causes of boiler explosions were known, they could be prevented. The Polytechnic Club spent much time debating an idea that combined insurance with a boiler inspection. They reasoned that inspections would increase boiler safety, and the insurance would function as an incentive to inspect and a guarantee of a quality inspection. Though the insurance offered financial interests, it was secondary to safety and loss prevention—a totally new concept for an insurance offering. This initiative established standards for the U.S., forming the Hartford Steam Boiler Inspection and Insurance Company (HSB). Today, that premise applies to equipment beyond boilers, from water supply systems to heating and cooling, electrical power, refrigeration, and telecommunications.

Similarly, the data revolution has faced its own struggles. The lack of secure, standardized ways to share financial data left the ecosystem vulnerable to data leaks, fraud, and inefficiencies. To address this, the Financial Data Exchange (FDX), an industry standards body, was formed, bringing together North American banks, fintech firms, and technology providers, thereby creating a safer, more efficient way to exchange financial data. In October 2024, the Consumer Financial Protection Bureau (CFPB) announced Section 1033 of the Dodd-Frank Act, a significant milestone in part influenced by the work of FDX in setting standards for financial data sharing. And in January 2025, FDX was recognized by the CFPB as a standards-setting organization for Section 1033 of Dodd-Frank. Gaps for ongoing monitoring still exist today, and we have yet to finalize an agreement around liability. As professionals in the financial and tech industries, our roles in advocating for and implementing solutions for these gaps and ongoing standards are crucial to the future of our industry.

The Outcome: Innovation and Safety

HSB was founded to improve steam power safety through engineering innovation and insurance incentives. Regular inspections and improved engineering led to safer, more efficient boilers, fueling further Industrial Revolution progress. From steam to data, history has shown that progress requires both innovation and safeguards. Just as the HSB proved that steam power could be harnessed safely, Invela is leading the charge in protecting the exchange of financial data through efficient and scalable third-party risk management and insurance coverage for open banking. The lesson remains the same: innovation comes with great responsibility. In the ever-evolving landscape of open banking, the continuous validation of credentials, adherence to proper standards, and insurance coverage are crucial and urgent. They are the key to a constant flow of new and improved financial service offerings for everyone.